Dear AquiPor Investors,

I'm pleased to share with you our quarterly update as we come out of the Summer months with a lot of momentum. We continue to wring the technical risks out of our concrete technology as we prepare for commercialization, while quietly developing the markets for our products and I'm excited to share some of these details with you in this update.

Product Development:

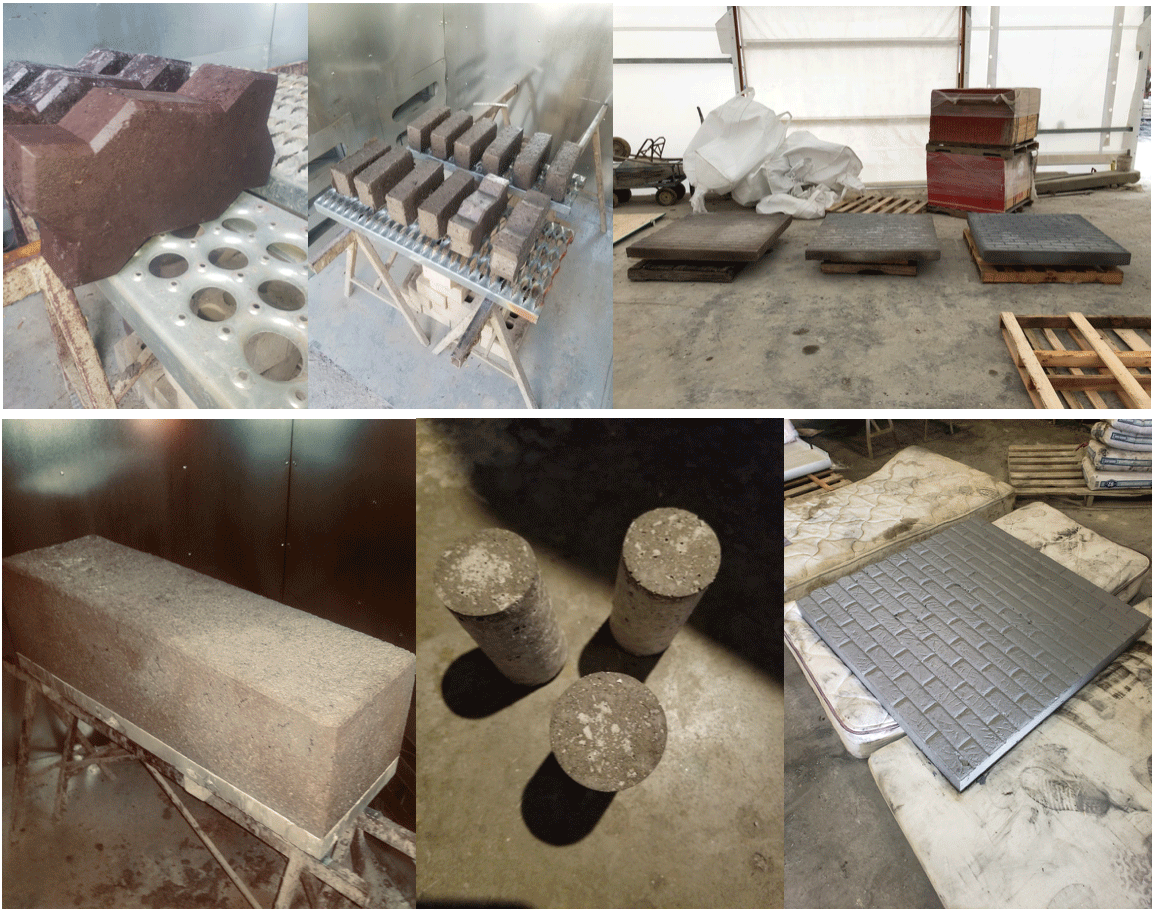

On the product development front, we've made a key improvement to our porous concrete technology that makes it much easier to manufacture at scale, resulting in what we believe to be our most adoption-ready version of the technology to date.

By blending the best performance aspects of our Catalytic concrete with the ease-of-production offered by traditional concrete technology, AquiPor's technology is now fully compatible with current paver and precast manufacturing practices.

Over the next several weeks we'll be finalizing project-ready mix designs for both pavers and precast panels. We are currently conducting performance testing for strength, durability, permeability (mass flow), and filtration. In addition to its improved manufacturability, our initial performance data suggests that this mix outperforms earlier versions of our technology in terms of strength and durability as well

AquiPor's porous concrete technology now blends the best attributes of our chemically bonded, metal-based concrete with the best attributes of traditional concrete mixes, making it easy to produce and improving its performance. In the pictures above, the exposed aggregate finish is another aesthetic improvement we've recently made.

Cast-In-Place version is now Under Development:

While still very much under development, we are also advancing a pour-in-place version of our porous concrete technology (for e.g. light vehicular roadway shoulders, runways, parking lots, etc.). A question that we're often asked is whether AquiPor can be used to pour high-volume surfaces such as roadways. This development gets us one step closer to that objective and we believe demonstrates the versatility and inherent innovation with this technology.

Due to patenting considerations, there isn't much technical detail that we can lend yet. What I can say is this mix also batches and pours almost identically to ready-mix, pour-in-place concrete. The big difference between this version of our technology and traditional pervious concrete is that we can densify the mix to eliminate large voids (which are prone to clogging), and filter stormwater without clogging the system.

We believe that a pour-in-place version of the technology greatly expands the use cases of our porous concrete, especially for larger surfacing projects. We will continue to develop this version of the technology by taking it through the appropriate engineering paces and performance testing for cast-in-place paving over the next several months.

This small demonstration shows the cast-in-place version of our technology. We simulate the accumulation of dirt and debris (e.g. from a construction site) in an attempt to clog the installation. We then use a power washer to maintain the surface, helping return the material to full permeability.

Scaling Up Material Supply:

We've begun working with a key supplier to develop a three phase plan for scaling up material supply of our Catalytic concrete materials over the next 3 years. We're developing the plan to support our initial project opportunities in the near term, but also with an eye toward meeting our project growth objectives longer term, and continually lowering our material costs as we grow.

As part of this plan, our supplier intends to conduct a professional feasibility study to determine the viability of vertically integrating the production and sizing of our raw concrete materials, which will also help determine our unit economics at a much larger scale.

I am already encouraged by the initial unit economics for our products as we prepare to go to market, and this strategic plan by our supplier should lower our material input costs and lead to more robust margins as we grow.

Market Development:

We are discussing a project partnership that would facilitate the financing and construction of up to 1 mile of AquiPor’s permeable sidewalk system as a demonstration project. This pilot would be a first of its kind permeable sidewalk infrastructure project, with the target location in Southern California. We are in the very early stages of planning and will announce more as these plans come together.

There are also a handful of smaller pilots we are also looking at as early as this year and into 2025, including a small commercial retrofit for which we've obtained a non-binding Letter of Intent. Even though these opportunities are smaller in scope, we're determining the feasibility of each opportunity based on the timing of each project coinciding with material supply availability and manufacturing capabilities, as well as project financing considerations.

In addition to private sector market opportunities, we are regularly monitoring and applying for relevant grant and project opportunities from U.S. federal agencies, including the EPA, NSF, USDA, and DOE. We are becoming more comfortable with the process and due to the time commitment required for these opportunities, we see the value in adding a project manager with a grant writing and public policy background as we expand our headcount and grow.

Quarterly Sales and Expenses:

Thus far in 2024, our effort remained focused on technology and market development, with no notable sales and no notable expenses reported. We are maintaining a conservative burn rate, averaging $45k per month, with cash inflows averaging $53k per month through August.

Industry Updates:

1. The U.S. stormwater infrastructure market continues to see significant growth driven by increased investment in climate resiliency. We're keeping an eye on these developments and couldn't help but notice New York City recently allocate $32 Million to install porous pavement throughout 7 miles of road infrastructure in Brooklyn, NY. This signals the market growth and expedited acceptance of permeable paving and green infrastructure in cities.

2. Additionally, with Senate Bill 596 and companion Bill 778, California has become the first state to require specific emissions reductions from the cement industry. Concrete is now included in California's Buy Clean program, requiring contractors to use low-carbon building materials for state contracts. This could be a tailwind for AquiPor as we introduce our products to the market.

3. Boston's Water and Sewer Commission recently implemented a stormwater charge that applies to all properties with more than 400 square feet of impervious surface area. Several U.S. cities have imposed similar stormwater fees to raise funds for water infrastructure improvements. Because charges are based on the impervious surface cover of the property, we anticipate greater demand for permeable pavement and green infrastructure among property developers.

Future Plans:

Through the remainder of 2024 we'll continue to focus on the technical readiness of our porous concrete technology as we push closer to commercialization. We're also working toward supply and manufacturing partnerships, in-ground demos, and securing pilot projects.

In terms of financing the next leg of company growth, we are strongly considering a new capital raise toward the end of the year to maintain our momentum and achieve our Company milestones. We will share details as we're able to, per SEC regulations.

In closing, we appreciate your support and appreciate the insights and opportunities you continue to bring to us! If you know of any future projects or significant opportunities, please let us know. Thank you from the entire AquiPor team!

Looking forward to the journey ahead,

Greg Johnson

AquiPor Technologies, Inc.

CEO

Dear AquiPor Investors,

We have a new quarterly update for you - packed with some really important information on the future of AquiPor.

We're shifting our focus from R&D into production and process efficiencies, so that we can leverage our upcoming pilot projects for the most impact.

Scaling up isn't just about volume of product, but making it easy for AquiPor partners to use and replicate our product and process around the world.

Please watch our CEO Greg Johnson give our 1st quarter update for 2024.

Dear AquiPor Investors,

In case you couldn't make our recent investor event, you can watch the recording here

In this update we recapped our milestones from 2023, outlined our longer term plans for 2024, and discussed our objectives for the immediate future.

Check out the full recording below and as always, please give us your feedback, comments, and questions.

-The AquiPor Team

Dear AquiPor Investors,

We had a good first quarter as we continued to advance our permeable concrete technology and prepare it for the market. We are now starting to shift into project mode.

We have been working with BW-IGC, Inc. (“IGC”), a private concrete tech and supply company, to fully develop the permeable version of what looks to be the first Net Zero CO2 concrete. This concrete also utilizes industrial mining waste as part of the mix. Along with being eco-friendly, this improved permeable concrete has some very interesting characteristics in terms of porosity and its ability to handle large volumes of water.

(A recent paver prototype.)

As we’ve engaged in R&D, we’ve also been running market discovery exercises to form a clearer picture of what demand for this technology might be. With the recent weather events in California alone, it’s not surprising that there is strong demand for what we’re developing. With this knowledge, we’ve been working with IGC to develop the critical supply and value chains to be able to take on sizable project opportunities.

The raw materials that go into our permeable concrete are industrial commodities from the iron and agricultural industries, as well as expendable “leftovers” from coal fired power generation. Our ability to repurpose this material and use it in our concrete can have important economic and environmental advantages.

(Our product uses very fine aggregates, which can include reclaimed mine tailings.)

As we organize our supply network, our project funnel has also been growing. This is a good sign, especially since we have not been doing any direct marketing of our products. The expressed interest has been purely organic due to our visibility from previous crowdfunds and from “boots on the ground” customer discovery. It’s led to project opportunities that vary in size and scope, and we are analyzing each opportunity to determine which ones are feasible now given our current capabilities and finances.

To amplify our capabilities, we are eyeing strategic partnerships with industry players in key markets in the West. We’re in discussions with a paving contractor that specializes in decorative paving and “complete street” contracts in the Phoenix, Los Angeles, and San Antonio, TX markets. Our product fits with their model and they are well-networked with municipal officials and developers in the Southwest. As we take our product to market, they represent a potentially valuable sales arm in that region.

Financially, we’re staying prudent with cash on hand as we prepare to go to market. To help support the next phase and bridge us into projects, we’ve opened up a $5M capital raise under a Regulation D, 506(c) filing for accredited investors. Full terms of the offering, use of proceeds, and other information can be made available upon request.

We’ll continue to monitor the startup funding landscape and make further financing decisions based on market factors and the appetite of both accredited and non-accredited investors.

As we head into the spring season, we have momentum on multiple fronts: technology, supply & value chain, and market opportunities. We’ve been able to cultivate a valuable staying power as we worked through tedious technology and product development cycles. Now we’re eager to go into growth mode.

(Thanks to some heady R&D and a long phase of product development, we’re ready to look for our early market opportunities for this technology.)

To close out this update, here are a handful of fun little “extras” from the last couple of months:

AquiPor was named to the 2023 “Ignite 25 + 5” list, which recognizes the most compelling emerging startups from the Spokane, WA, Coeur d'Alene and Sandpoint, ID regions.

Our Cofounder and VP of Market Dev, Kevin Kunz, was a guest speaker at the Gonzaga University Center for Climate, Society, and the Environment where he gave an excellent presentation about Building Resilient Infrastructure in the Face of a Changing Climate.

In February, I had the chance to go onto the GreenNewPerspective podcast to discuss modernizing water infrastructure to account for extreme weather.

The mayor of the City of Miami - and aspiring 2024 presidential candidate - Francis Suarez now follows us Instagram (we know…it’s probably just his staffer, but still 🙂)

We were happy to support the recent efforts of our friend Augustus Doricko at Terra Seco Solutions, as he organized the procurement and installation of 1,900 whole-house water filters for residents of East Palestine, OH who were affected by the train derailment and vinyl chloride spill.

Thank you all for your continued support. We are getting there! I am looking forward to growing this Company and our vision is still bold. Let’s build AquiPor into the most formidable green infrastructure startup in America.

Please don’t hesitate to reach out to me directly if you have any questions or comments.

Ever forward,

Greg Johnson

Cofounder | CEO

Dear AquiPor Shareowners:

It's hard to believe that we are already into 2023. It's only been a few months since our last update, but we wanted to welcome in the New Year with a short recap of 2022 and then share our plans ahead for what's shaping up to be a really exciting 2023 for AquiPor from a global lens.

A lot happened in 2022, and AquiPor quietly kept its head down and just got things done.

We watched as many tech startups raised huge rounds of capital at sky-high valuation points, and watched with some envy, as we were in a position where we weren't quite ready to go out and raise that type of money. But predictably, once the Fed started tightening rates and volatility entered the markets in early 2022, most of those same venture-backed startups began to flame out.

They just couldn't sustain the sort of that artificial growth that easy money had enabled. The paradox of all of this is out of necessity. We had to take a completely different approach altogether, and it has helped us. So due to the nature of our technology development, we had no choice but to remain conservative through the boom cycle. And instead of spending frivolously on unnecessary expenses, you know, the money that we were able to raise, we made some strategic and at times small but asymmetric bets or investments on technology development that we are now starting to see pay off.

Watch our end-of-the-year video and see how we viewed 2022 and what 2023 has in store. We know this year is pivotal and we’re so excited to continue the process of building revolutionary green tech.

AquiPor just received 3rd party testing results on the absorption rate of our technology. Why is this important? According to ASTM C […]

Urban flooding, aging infrastructure, and polluted waterways are symptoms of a broken stormwater system—one that wasn’t built for the climate challenges cities […]

When LA turned it’s river into a storm drain Starting in the 1930’s Los Angeles turned the LA river into a big […]

Copyright © 2025 AquiPor Technologies. Site designed & developed by Houdini Interactive.